Company Profile

Founded in 1996 and listed on the Shanghai Stock Exchange (stock code: 605299), Shuhua Sports Co., Ltd. (SHUA) is one of China’s leading providers of fitness equipment and scientific exercise solutions. The company integrates R&D, manufacturing, marketing, and fitness services, with products ranging from cardio and strength training machines to outdoor fitness paths and customized fitness solutions for government, enterprises, and households.

SHUA has built a strong brand presence in China and is expanding globally, with its business footprint now covering more than 110 countries and regions. It has been recognized for its innovation, winning multiple domestic and international awards, and has cooperated with global events such as the Asian Games and Asian Winter Games.

With this background, we now turn to SHUA’s 2025 half-year financial and operational performance to provide investors and industry observers with a clear picture of its current situation and future outlook.

1. Core Financial Performance

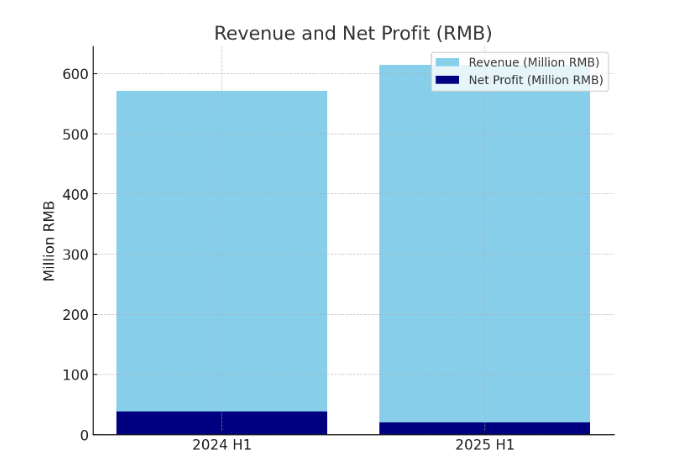

1.1. Revenue and Costs

Operating revenue reached RMB 614.39 million (≈ USD 86.56 million), a year-on-year increase of 7.52%.

Operating costs totaled RMB 421.05 million (≈ USD 59.31 million), rising 8.81% year-on-year, faster than revenue growth, squeezing gross margins.

1.2. Profitability

Total profit was RMB 25.71 million (≈ USD 3.62 million), down 46.18% year-on-year.

Net profit attributable to shareholders was RMB 20.18 million (≈ USD 2.84 million), a decline of 47.44%.

Net profit excluding non-recurring items was RMB 17.55 million (≈ USD 2.47 million), down 29.32%.

1.3. Earnings per Share (EPS)

Basic EPS stood at RMB 0.05 (≈ USD 0.007), a year-on-year decrease of 44.44%.

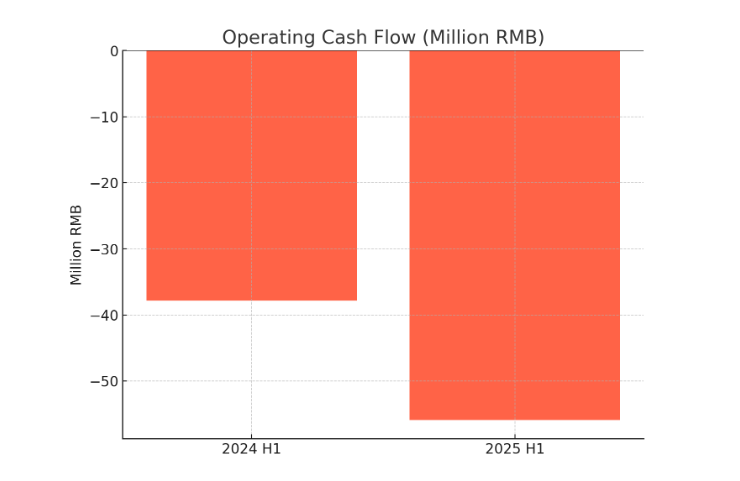

1.4. Cash Flow

Net operating cash flow was negative RMB 55.93 million (≈ USD -7.88 million), worse than the negative RMB 37.84 million a year ago, mainly due to higher procurement spending.

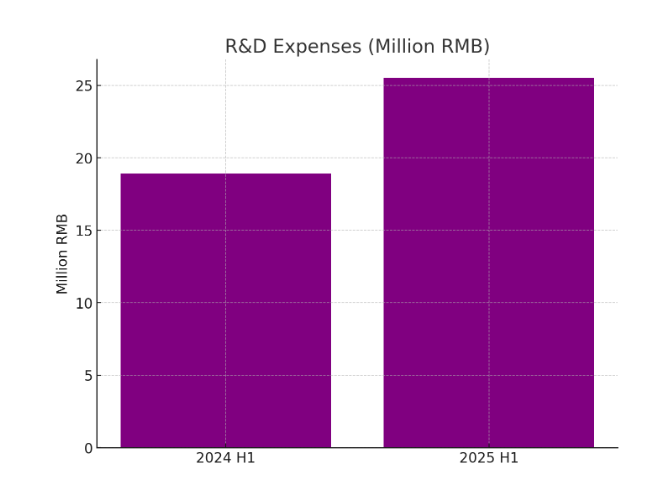

1.5. Expenses and R&D Investment

Selling expenses were RMB 84.08 million (≈ USD 11.84 million), up 17.04%, reflecting increased spending on exhibitions and marketing.

R&D expenses reached RMB 25.51 million (≈ USD 3.59 million), up 34.87%, showing SHUA’s continuous focus on innovation.

2. Assets and Liabilities

Total assets stood at RMB 1.91 billion (≈ USD 268.10 million), down 5.78% from year-end 2024.

Net assets attributable to shareholders were RMB 1.21 billion (≈ USD 170.42 million), down 5.63%.

Cash and cash equivalents were RMB 467.49 million (≈ USD 65.87 million), a 14.44% decrease.

Inventories rose to RMB 276.07 million (≈ USD 38.88 million), up 17.33%, adding potential risk of overstocking.

Accounts receivable were RMB 292.84 million (≈ USD 41.26 million), down 10.72% year-on-year, but still accounted for 26% of current assets.

Short-term borrowings increased to RMB 290.09 million (≈ USD 40.86 million), up 24.05%, reflecting rising liquidity needs.

3. Industry and Policy Background

The fitness equipment industry continues to benefit from national strategies promoting health and wellness:

In 2025, China issued the “Mass Sports Work Plan” and the “Guidelines for Elderly Fitness Equipment Configuration”, both aimed at boosting public fitness facilities.

A joint policy by the People’s Bank of China and other regulators provided financial support for the sports industry, especially in infrastructure and manufacturing.

Consumer demand is shifting toward professional, safe, intelligent, and convenient fitness equipment, while government procurement continues to grow, particularly in outdoor and smart fitness solutions.

4. Operational Highlights

4.1. Brand Expansion

SHUA maintained its strong brand reputation in China and enhanced its global presence by participating in major international exhibitions such as FIBO (Germany), IWF Shanghai, and Elevate London.

4.2. Strategic Partnerships

SHUA partnered with CENTR-HYROX, becoming its sole official agent in China. The cooperation covers event equipment and strengthens SHUA’s positioning in the premium commercial fitness segment.

4.3. Product Innovation

The company increased R&D investment, introducing products such as the I5 Smart Prescription Treadmill and the 88 Series strength machines, the latter certified by Germany’s IGR for ergonomics—marking a first among Chinese brands.

4.4. Service Business Development

SHUA has expanded into fitness service operations, now running more than 60 gyms and piloting the “1+1+1” model (equipment sales + fitness services + enterprise wellness solutions). This diversifies revenue streams and enhances customer engagement.

5. Risks and Challenges

5.1. Profitability Pressure

Despite revenue growth, net profit dropped nearly 50% due to higher expenses and reduced government subsidies.

5.2. Cash Flow Concerns

Operating cash flow remained negative, highlighting ongoing liquidity pressure.

5.3. Inventory and Receivables

Inventories increased sharply, raising the risk of obsolescence, while high receivables could affect capital efficiency.

5.4. International Uncertainty

Global expansion is exposed to risks from exchange rate fluctuations, trade barriers, and logistics instability.

5.5. Competitive Landscape

SHUA faces strong competition from global leaders (e.g., Technogym, Life Fitness) and domestic peers. Sustained innovation and service differentiation will be critical.

6. Outlook and Strategic Priorities

Long-Term Goal: SHUA aims to become a RMB 10 billion (≈ USD 1.41 billion) company by 2030, driven by its “Product Excellence, Brand Strength, Channel Depth, and Efficiency” strategy.

International Expansion: Continued investment in European and North American markets, alongside stronger global distribution networks.

Innovation: Focus on intelligent, digital fitness ecosystems integrating hardware and software.

Service Ecosystem: The “equipment + services” model, if scaled effectively, could become a major growth driver.

7. Key Takeaways for Investors

Short-term: Monitor profitability recovery, cash flow improvement, and inventory/receivables management.

Medium to long-term: Watch for results from R&D innovation, global expansion, and fitness service profitability.

Valuation: While current financial pressures weigh on earnings, SHUA’s strategic investments and industry positioning suggest potential long-term growth if execution is effective.

Conclusion

In the first half of 2025, SHUA achieved steady revenue growth (up 7.5%) but faced significant profit declines (down ~47%) and negative cash flow. The company is in a transition period, balancing near-term financial stress with long-term investments in innovation, internationalization, and service diversification.

For investors, SHUA represents both risks—due to short-term margin and liquidity challenges—and opportunities, thanks to policy support, global expansion, and its push toward a diversified fitness ecosystem.

Comments (0)

No comments yet, be the first to comment!